The Tax Domicile Report helps you track the number of days you spent in different tax jurisdictions throughout the year. This is crucial for understanding your tax residency status and potential tax liabilities in each jurisdiction. The report lists every day of the year and the tax domiciles you were in for each day. Here’s a detailed explanation of the report and how to use it:

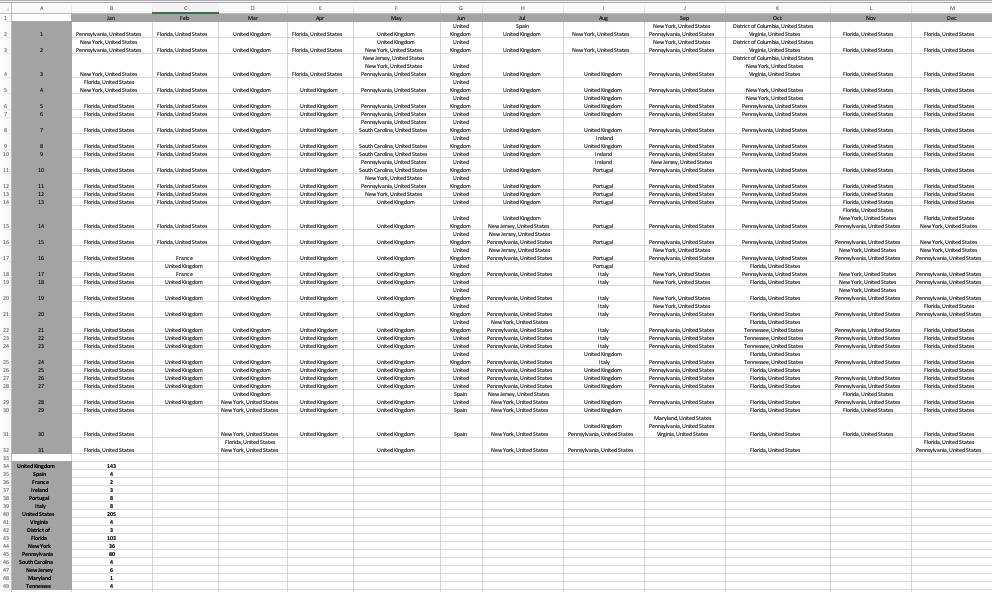

- Calendar: The report consists of a calendar displaying each day of the year, organized by month. Each day shows the tax domiciles you were in on that day. If you were in multiple jurisdictions on the same day, all visited domiciles are listed.

- Different Day Counting Rules: Keep in mind that each jurisdiction may have different rules for counting days. For example, New York State counts a full day even if you spent only a minute within the state, whereas the United Kingdom counts a day if you were there at midnight and also worked in the UK that day.

- Sum Total of Visits: At the bottom of the report, the sum total of visits to each jurisdiction is tallied. This provides an overview of how many days you potentially spent in each tax domicile, helping you understand which jurisdictions you may have tax liabilities in.

To use the Tax Domicile Report effectively, follow these steps:

- Review the calendar for accuracy: Ensure that the tax domiciles listed for each day accurately represent your travel and work history throughout the year. If there are any discrepancies, update the report accordingly.

- Familiarize yourself with the counting rules: Research the day counting rules for each tax jurisdiction you have visited. Understanding these rules will help you accurately determine the number of days you spent in each jurisdiction and whether you qualify as a tax resident.

- Calculate days spent in each jurisdiction: Based on the jurisdiction-specific counting rules, calculate the actual number of days spent in each tax domicile. Update the sum total of visits at the bottom of the report with these adjusted numbers.

- Evaluate your tax residency status: Determine whether you meet the criteria for tax residency in any of the jurisdictions you have visited. This will help you understand your potential tax liabilities and filing requirements.

- Consult a tax professional: If you are unsure about your tax residency status or have complex tax situations, consult a tax professional who can provide guidance on your specific circumstances.

By following these steps, you can effectively use the Tax Domicile Report to track and manage your tax residency status, helping you stay compliant with the tax laws of each jurisdiction you visit.

SAMPLE TAX-DOMICILE / JURISDICTION REPORT

What is the purpose of the Tax Domicile Report?

The Tax Domicile Report is designed to help you track the number of days you spent in different tax jurisdictions throughout the year. This information is essential for understanding your tax residency status and potential tax liabilities in each jurisdiction.

How do I read the calendar in the Tax Domicile Report?

The calendar in the report displays each day of the year, organized by month. For each day, the tax domiciles you were in are listed. If you were in multiple jurisdictions on the same day, all visited domiciles are listed together.

Are the number of days listed at the bottom of the report definitive for my tax residency status?

The sum total of visits at the bottom of the report provides an overview of the days you potentially spent in each tax domicile. However, each jurisdiction may have different rules for counting days, so it’s crucial to research and understand these rules to determine your actual tax residency status accurately.

How do I find out the day counting rules for each tax jurisdiction?

The day counting rules for each tax jurisdiction can usually be found on the official websites of the respective tax authorities. You can also consult a tax professional for guidance on understanding these rules.

What should I do if I find discrepancies in the Tax Domicile Report?

If you notice any discrepancies in the report, you should update it to accurately reflect your travel and work history throughout the year. Ensuring the accuracy of the report is essential for determining your tax residency status and potential tax liabilities. Also, please contact us if you think our programming went a bit heywire! (but keep in mind, we are only as good as your phone logs)

How do I calculate the actual number of days spent in each tax domicile?

To calculate the actual number of days spent in each tax domicile, you need to understand and apply the day counting rules for each jurisdiction. Based on these rules, update the sum total of visits at the bottom of the report with the adjusted numbers.

Can the Tax Domicile Report help me with my tax filing requirements?

The Tax Domicile Report can help you understand your potential tax liabilities and filing requirements by providing an overview of the days spent in each jurisdiction. However, you should consult a tax professional for specific guidance on your tax filing requirements, as tax laws and regulations can be complex and vary between jurisdictions.

How often should I update the Tax Domicile Report?

Well, probably just once a year when you need to send your movements across to your accountant; however, you may also update the Tax Domicile Report anytime you like. Keeping the report up-to-date will help you stay on top of your tax residency status and potential tax liabilities throughout the year.